Why Should I Start Saving For Retirement In My 20s?

Being in my mid-20s, I speak to friends also in their 20s all the time about starting to save for retirement. In the vast majority of these conversations, most people tell me that if they have any kind of savings, retirement savings are the last thing on their mind and they’re more focused on saving for a more immediate goal; buying a car, moving out of their parents’ home, paying off college debt, or saving up for grad school.

While it is getting harder and harder just to get by in America, it is incredibly important for long term financial stability that you begin saving for retirement as soon as you are able to. Tucking away a few thousand dollars each year may not feel like much, but over time it will add up, not just from you adding more each year but also due to compounding investments.

Rule of 72

The rule of 72 is a method you can use to determine the number of years it will take an investment to double based on the annualized rate of return. The rule says that if you take the number 72 and divide by the return rate as a percentage, the result will tell you the number of years the investment will take to double. Let’s look at some examples to see how this works.Money invested with a 10% APY will take 72 / 10 = 7.2 years to double.

Money invested with a 9% APY will take 72 / 9 = 8 years to double.

Money invested with a 8% APY will take 72 / 8 = 9 years to double.

Money invested with a 7.2% APY will take 72 / 7.2 = 10 years to double.

In the next section we’ll take a look at the historic performance of the stock market over the last 50+ years. That will show why we are able to make the assumption that 7.2% APY averaged over time is a reasonable rate of return to expect for long-term investments. Assuming that we are able to achieve this annualized rate of 7.2% returns (with all dividends and gains reinvested), this means that retirement savings should double roughly every decade. Of course, the time frame will be slightly longer with a lower rate or shorter with a higher rate.

Doubling retirement savings every decade due to investment helps to demonstrate the power of beginning to save for retirement in your youth. This means every dollar invested towards retirement in your 20s is worth roughly 4x what the same dollar put towards retirement in your 40s would be. Similarly it would be worth 8x money saved in your 50s, or 16x money saved in your 60s, ideally when you should be considering retiring. Compounding is the single most powerful tool in saving for retirement, and the sooner you begin saving, the more time those savings have to compound. If you start saving for retirement early, there will be significantly less that has to be saved than if you wait to begin.

Historic Performance

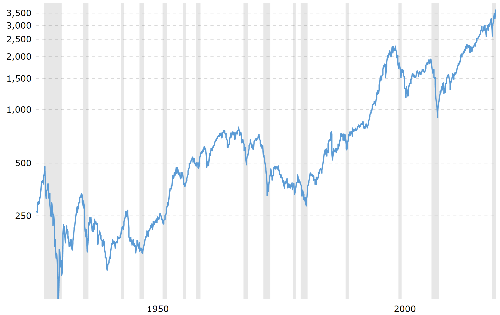

If we look back to past stock market performance through history, there have been a considerable number of “crashes”. Despite these, the overall market is worth many times more today than it ever was at the highest point immediately before any of these crashes. The chart below shows the performance of the S&P 500 index over roughly the last 100 years.

We can see from the chart above that given a long enough time frame, the entire stock index has historically always increased. There are two notable periods of extended decline from all-time highs until a new all-time high is hit; one began in the late 60’s and the other started with the dotcom crash at the turn of the century. The market did not recover to highs seen at the peak of the dotcom boom until well into the recovery from the Great Recession.

As investors, we ideally want to buy at the lows rather than the highs. However, realistically speaking, timing the market is a fool’s errand. There’s an old saying that more money has been lost waiting out rallies in the anticipation of a crash than in the crash itself. If you’re in your 20s or 30s saving for retirement, based on historical data, stocks are guaranteed to be higher than they are today by the time you’re starting to think about retiring. Keep in mind this is true for indices as a whole; when investing in individual stocks however, there is always a chance for the company to go under and your investment to be lost.

Averaged over time, the stock market has returned roughly 10% per year. This is quite a bit better than the 7.2% we need to double an investment within 10 years and helps to demonstrate the power of beginning to save early. With a 10% return, rather than doubling twice in 20 years, returns would double three times in just over 21 years.

However, there’s always a chance that we are buying into the market in the midst of the highs of a bubble. It would be terrible to save up for a few years and put all your money into an index fund, only for the market to crash the next day. You could be stuck sitting on that money, unable to touch it without taking a loss for over a decade! Fortunately, there’s a buying strategy called dollar cost averaging that helps us to keep from getting burned in a crash.

Dollar cost averaging is an investment strategy where instead of putting a large amount of money into the market at once, you continually put smaller amounts in. This helps to lessen the swings in price that can happen on any individual day. Most Americans have regular income that they earn from working a job. Dollar cost averaging is a way of investing which very easily fits into this framework. Recurring transfers from a checking account into an investment account help to automate this process.

Receive personal finance tips and tricks directly to your inbox, and get exclusive access to our monthly budget template